IRの力で企業価値向上に貢献する ジェイ・フェニックス・リサーチ株式会社

Condominium development /sales/real estate agency

- Industry-classified analysis report about corporate value

Analyze based on the scenario of the double market capitalization compared to the present.

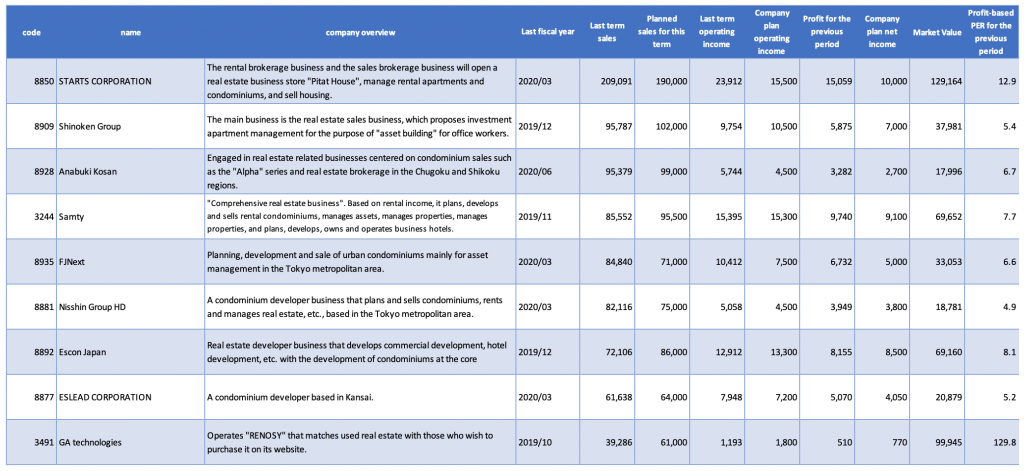

In this report, J-Phoenix Research Co., Ltd. (JPR) ranks by ROIC for each specific industry, and shows the prerequisites for the double market capitalization about the top companies below. This time, we are targeting companies with company planned sales of 30 billion yen or more in classified as condominium development / sales / real estate agency in the industry classification by Nikkei at the time of analysis.

▉ Analysis list in this report

(Source) Created by JPR from FactSet, Nikkei Needs data, as of October 20, 2020, all sources are the same

Important message

At the time of analysis(2020/10/20), we analyze following three companies according to ROIC ranking based on each planning companies especially based on the scenario of the double market capitalization compared to the present; the first place is Shinoken Group Co.,Ltd. (policy number:8909), the second place is GA technologies(3491) and the third place ES-CON JAPAN Ltd. (8892). As a result, we conclude those three companies can realize the scenario of the double market capitalization compared to the present. When ranking by feasibility of the senario, Shinoken Group Co.,Ltd.>ES-CON JAPAN Ltd.>GA technologies are.

Feasibility of the senario of the double market capitalization

Shinoken Group Co.,Ltd. is the feasiblest companies in the three companies, as a result of Stress Test. Even if profits declined 10% compared to the company's plan in the fiscal year ending December 2020 (then decreased by 10% from the forecast until 2031) and sales decreased by 5% (similarly after that, the shareholder value decreased by 5%), shareholder value is estimated to be more than double the market capitalization.

Shinoken Group Co.,Ltd. has a strong image of an "apartment" and seems to be underestimated due to fraudulent issues in the industry. However, when analyzing the latest releases and explanatory materialsin recent years, it has a wide range of business structures such as nursing care and energy business. We are also focusing on real estate tech and achieving results overseas (especially Indonesia). When these objective facts are widely recognized by general investors, it can be said that the double scenario is fully feasible.

On the other hand, GA technologies is less feasible than Shinoken Group Co.,Ltd., because it is necessary for GA technologies to continue to significantly improve its business performance. It is also necessary to improve the profit margin. It is possible in view of the current trend, but it is judged that the feasibility is relatively low compared to the Shinoken Group, which will realize a double scenario even if profits decline and realize the double market capitalization. About GA technologies, it seems that the growth value of the current stock price has already been incorporated in considerably. Also, there is a risk that the stock price will drop significantly if expectations fall.

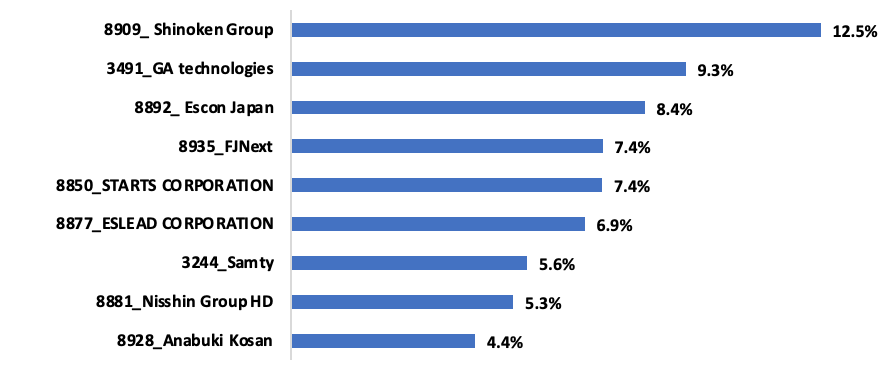

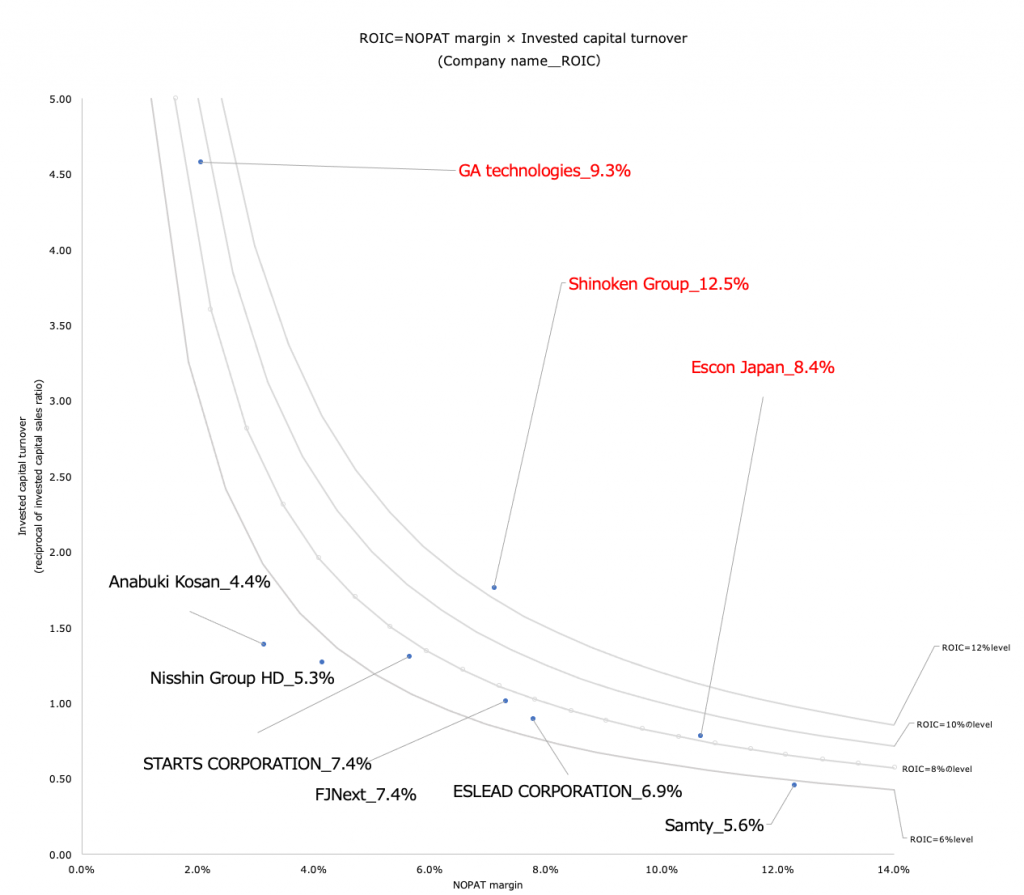

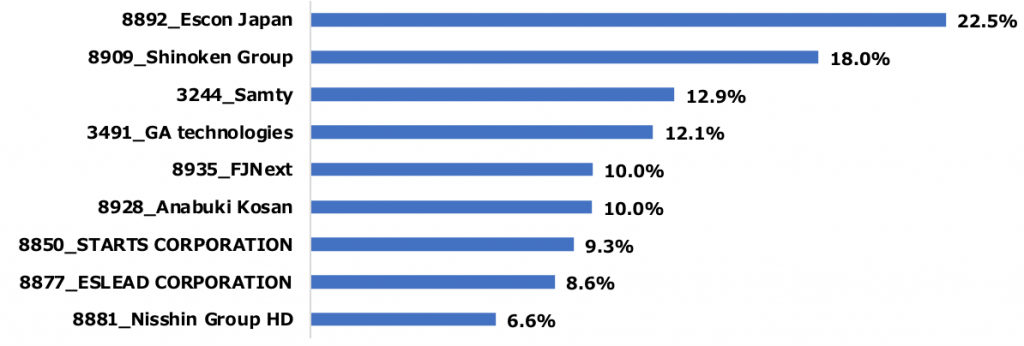

▉ ROIC ranking

Looking at the ROIC rankings, the first place is Shinoken Group Co.,Ltd. (8909), the second place is GA technologies (3491), and the third place is ES-CON JAPAN Ltd. (8892). We analyze the shareholder value on the premise of WACC 5% and make a hypothesis that the scenario of doubling the market capitalization at the time of analysis.

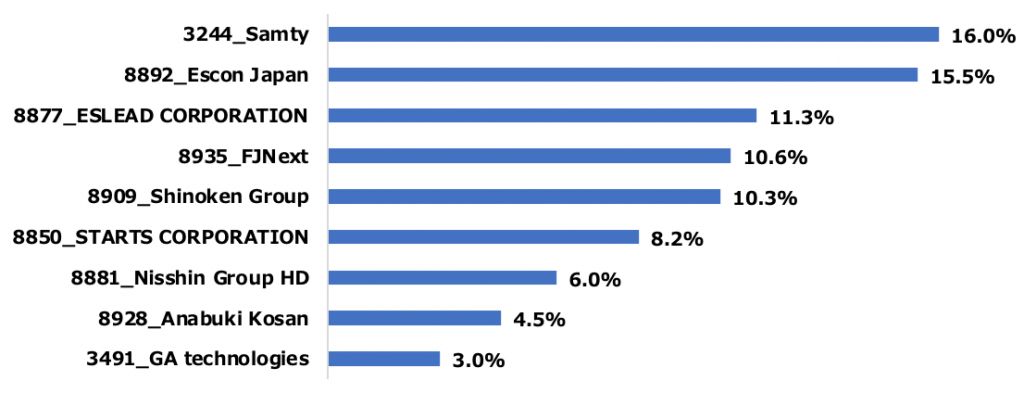

▉ ROIC(Invested capital is anlyzed based at the end of the most recent quarter, and operating income after tax is anlyzed based on this term's plan)

(Source) Created by JPR from FactSet, Nikkei Needs data, as of October 20, 2020, all sources are the same.

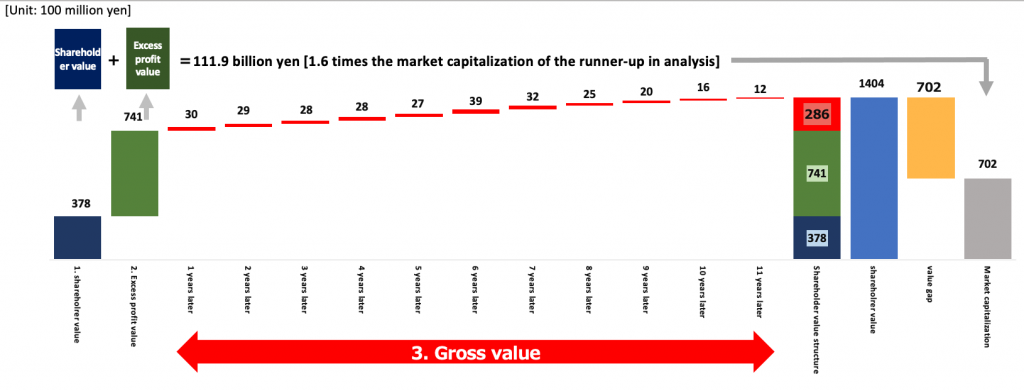

Shareholder value of the top three ROIC companies

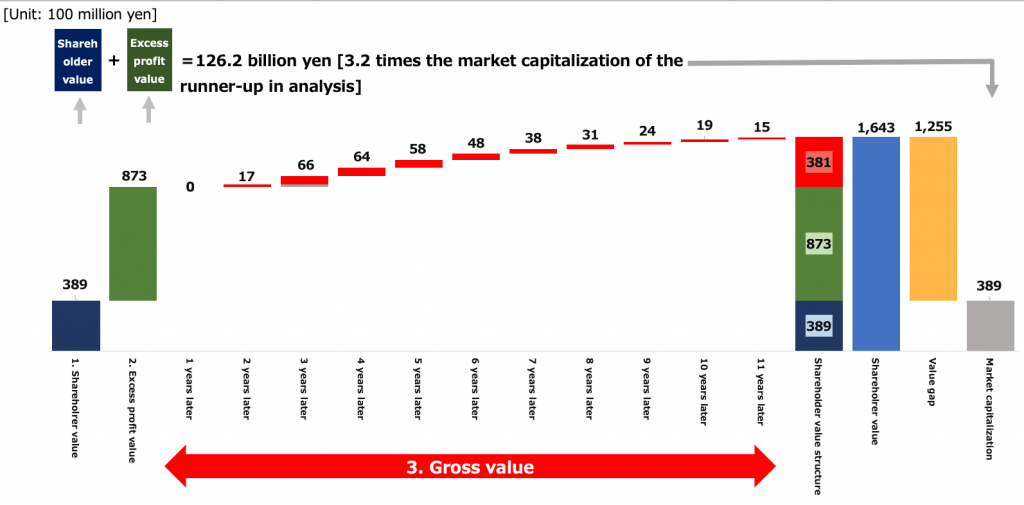

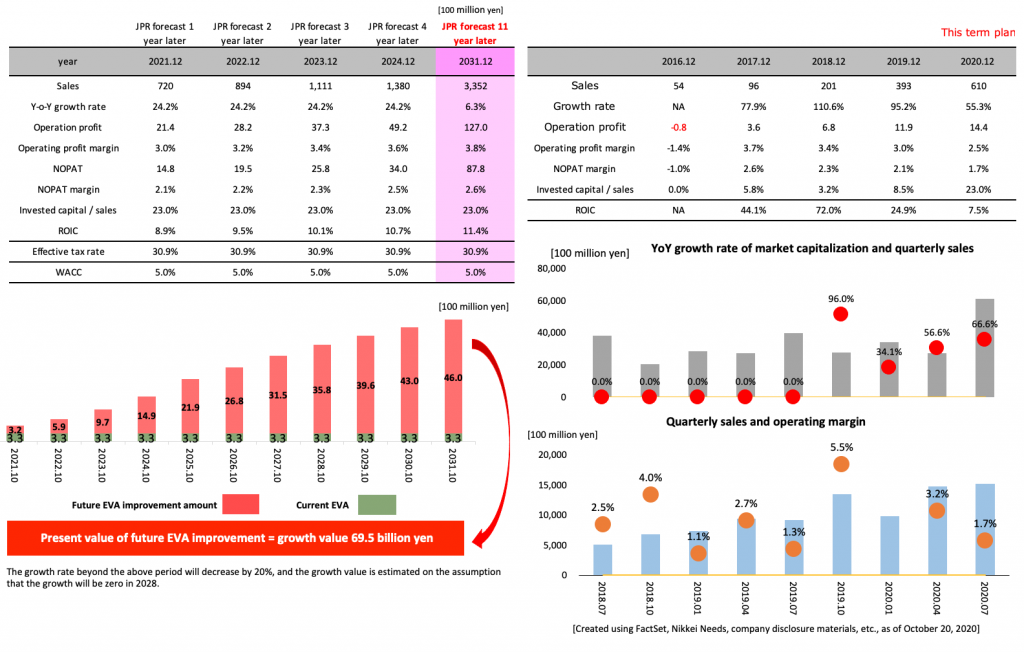

8909: Shareholder of Shinoken Group Co.,Ltd.

Analyze the scenario of double market capitalization

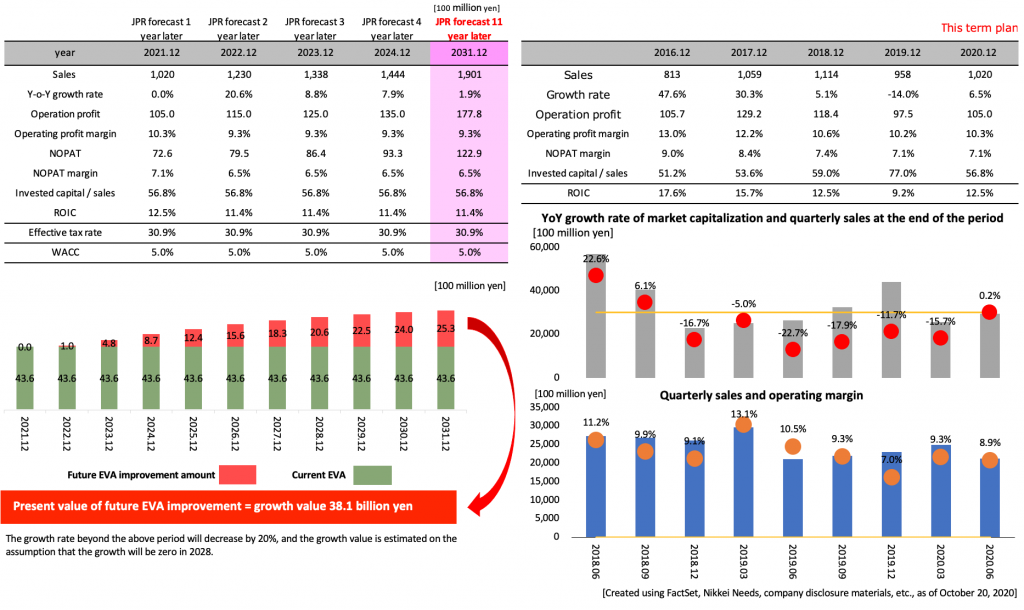

Simulation based on Company-planned value: assumption of WACC 5%

Even if it does not grow after the fiscal year ending December 2021, the shareholder value is estimated to be 3.2 times, and the double scenario will have been achieved.

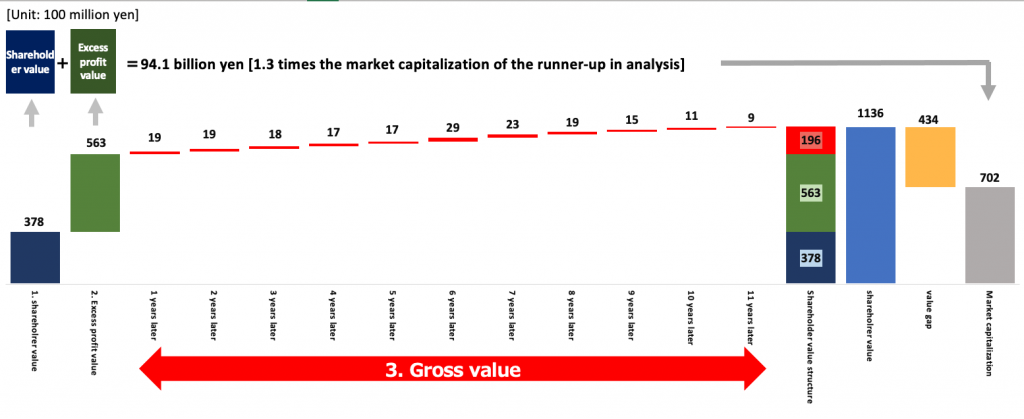

Despite being the top ROIC in the industry, Shinoken Group Co.,Ltd. (8909) ‘s PBR is less than 1 times, which means cheape stocks . The reason for this is that sales in FY12/2019 were -14% YoY. It is evaluated low by investors, and it is estimated that the excess profit value of 87.3 billion yen + the book value of shareholders' equity of 38.9 billion yen (=shareholder value is zero growth) is 126.2 billion yen, but the market capitalization is less than 40 billion yen.

▉ Based on Company-planned value::Current shareholder value VS Market capitalization analysis

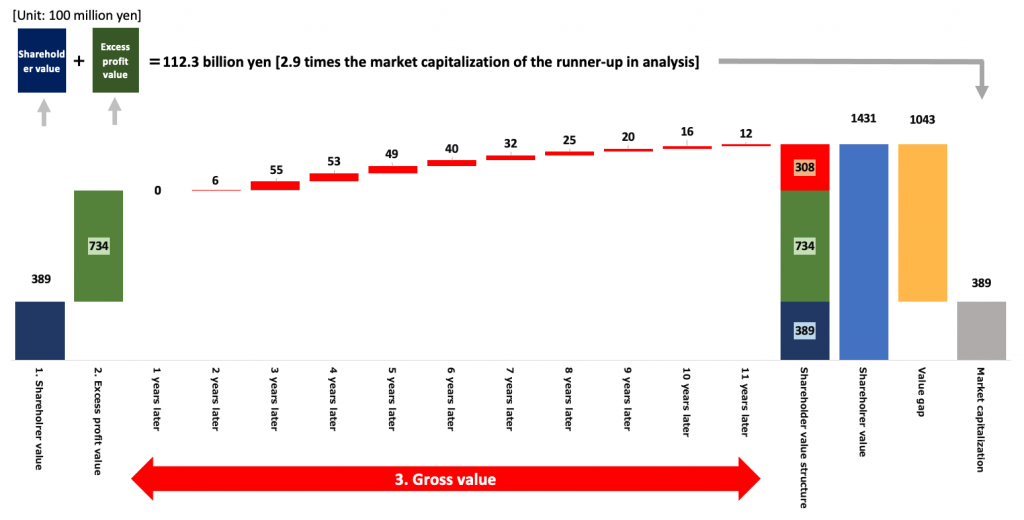

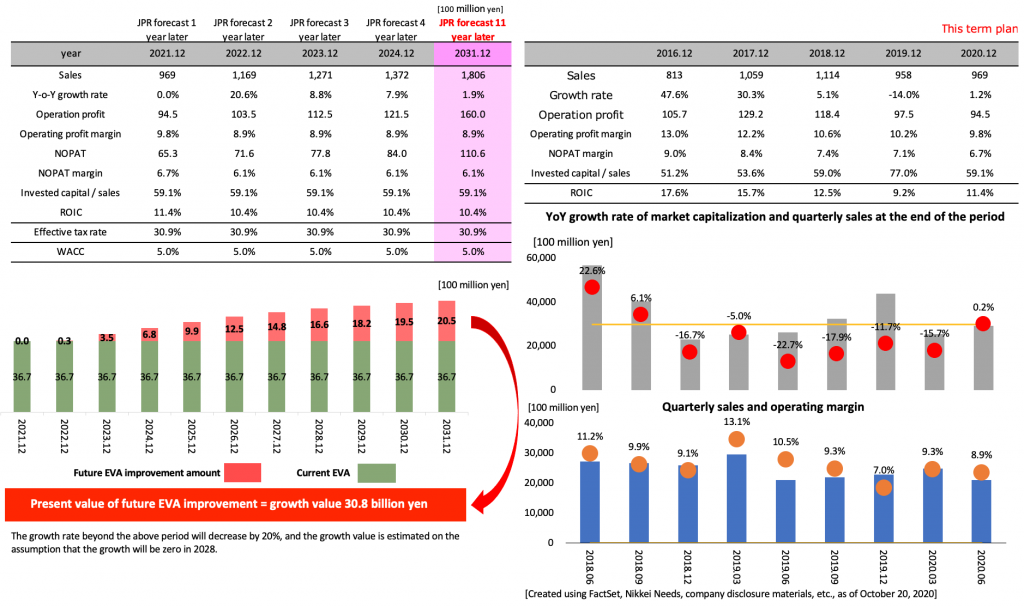

Stress test: Operating income decreased by 10% from the company plan, and then it decreased by 10% decreased (WACC 5%)

Shareholders' equity + excess profit value is estimated to be 2.9 times the market capitalization. Achieved double scenario even in stress test

Based on the assumptions on the previous page (company forecasts up to 11 years after 2031), we conducted a stress test assuming that operating income would decrease by 10% and sales would decrease by 5% until 2031. Even so, the sum of excess profit value + book value of shareholders' equity is 112.3 billion yen, which is 2.9 times the market capitalization at the time of analysis. Even if the company plan falls by 10%, it can be said that double the market capitalization is theoretically feasible. (the simulation analysis of "shareholder value = market capitalization double scenario" is omitted.)

▉ Stress test:Current shareholder value VS Market capitalization analysis

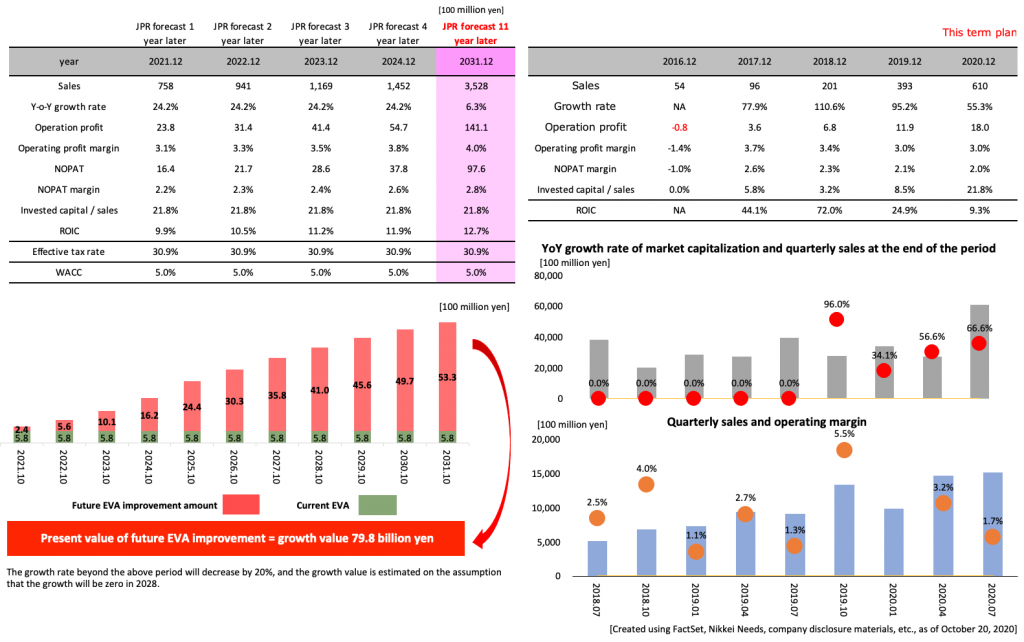

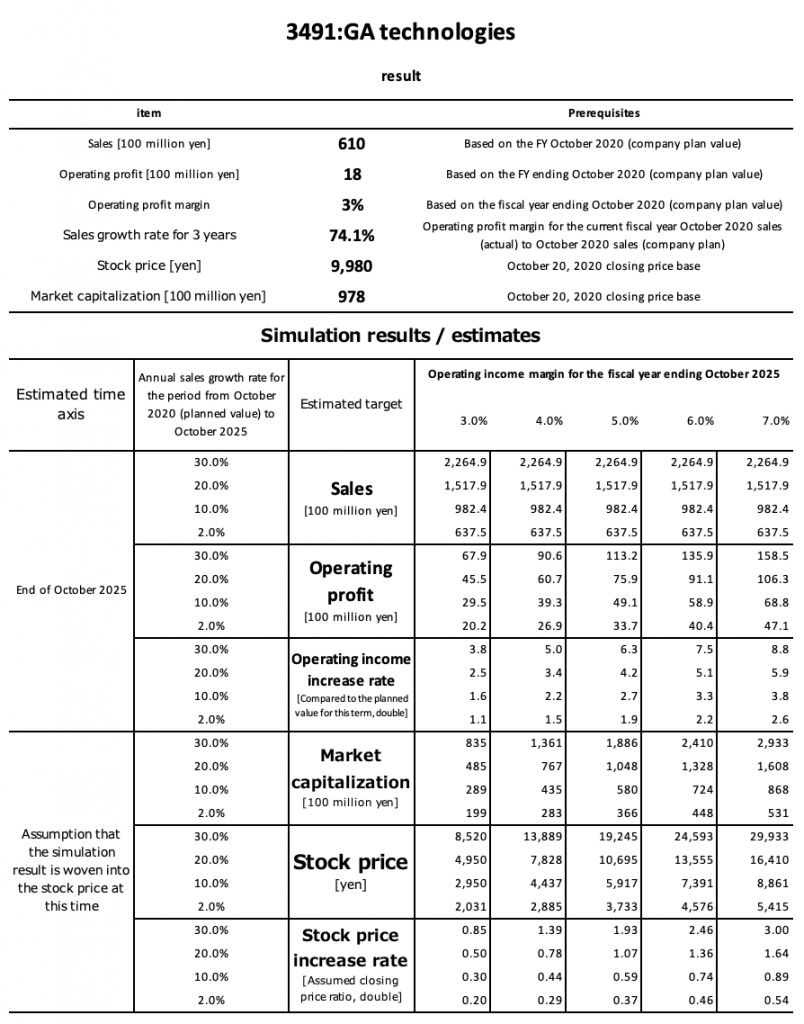

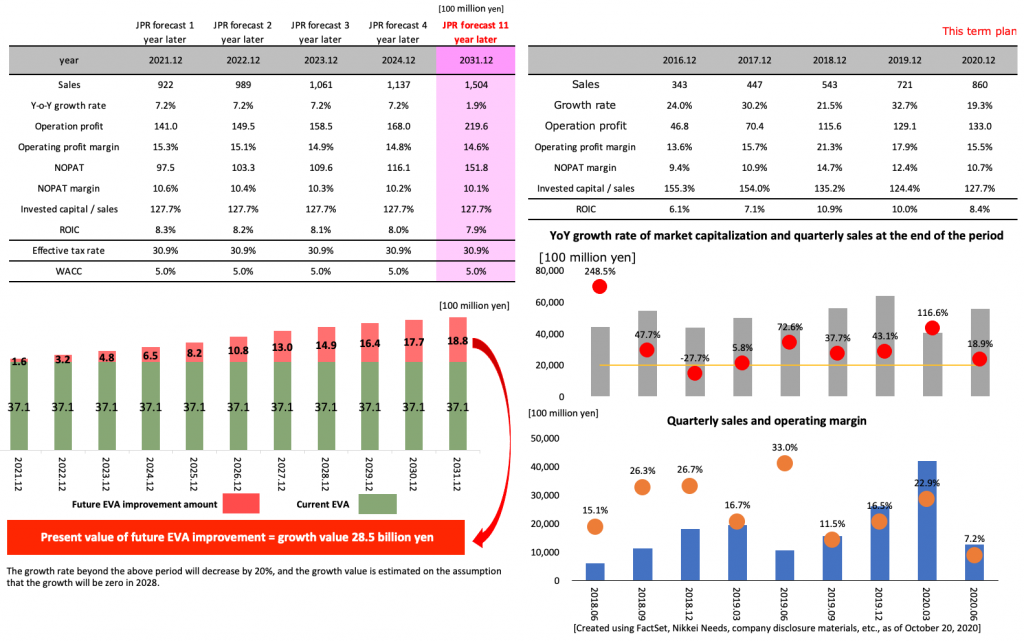

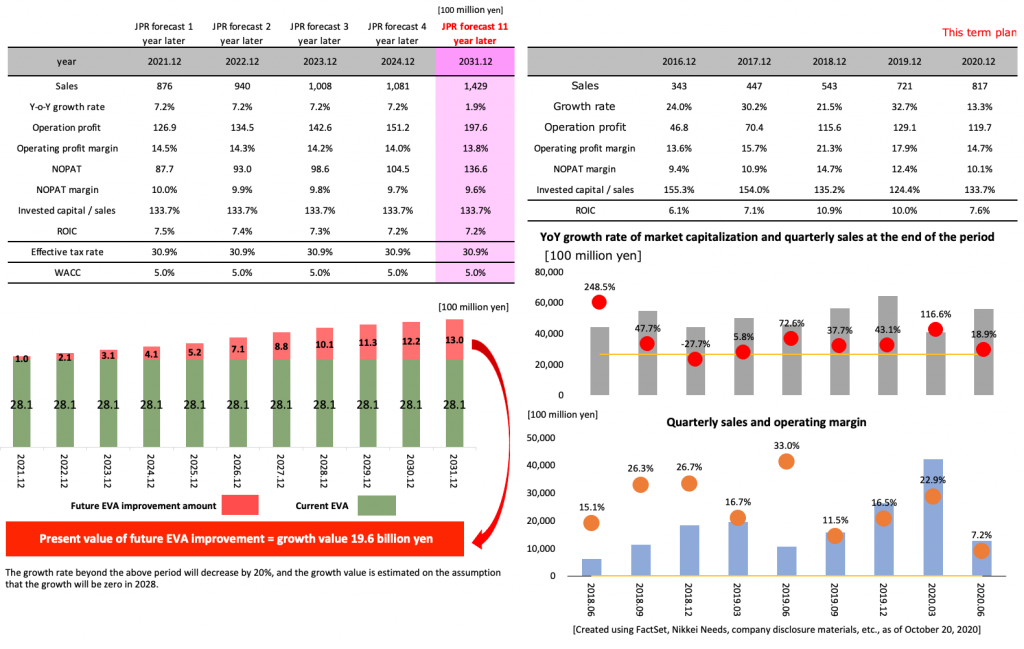

3491: Shareholder of GA technologies

Analyze the scenario of double market capitalization

Simulation based on Company-planned value: assumption of WACC 5%

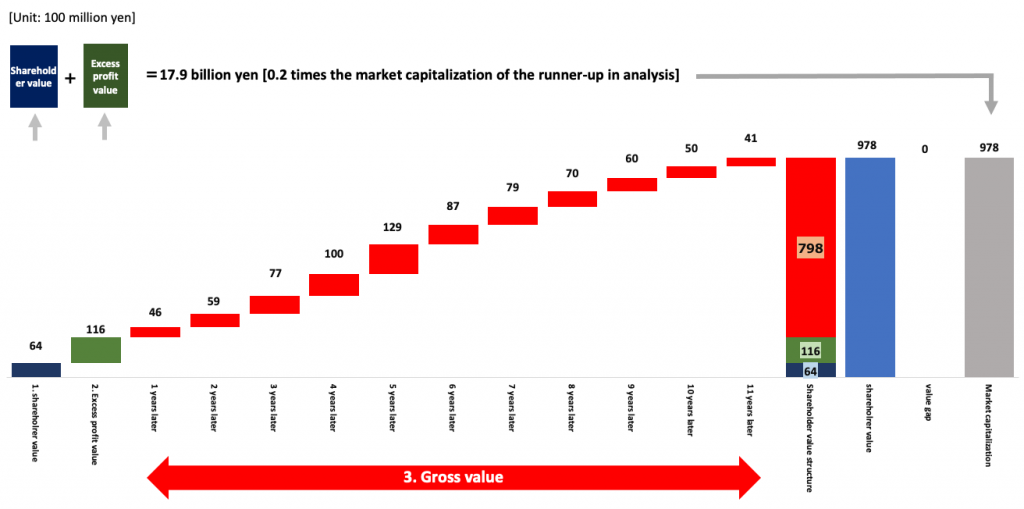

The total of shareholders' equity + excess profit value is 20 billion, but high growth is evaluated, and the growth value becomes 80 billion yen.

GA technologies(3491) has a total of shareholders' equity + excess profit value of less than 20 billion yen, but its potential growth value is close to 80 billion yen, and it is also estimated, and the market capitalization became 97.8 billion yen. Before analyzing the scenario of shareholder value = double market capitalization, we explain estimated the financial assumptions. It is assumed that the market capitalization of 97.8 billion yen will be explained by maintaining sales growth of 24% year-on-year for 5 years, and improving the operating profit margin from the current 3.0% to nearly 4% by the fiscal year ending October 2024. However, there is a potential risk that the growth value will drop significantly if doubts arise in the growth scenario.

▉ Based on Company-planned value::Current shareholder value VS Market capitalization analysis

Scenario of shareholder value = double market capitalization

If it maintains sales growth of 30% year-on-year for 5 years and improve the operating profit margin to 5% in 5 years, we can see a scenario where shareholder value = market capitalization is doubled. The scenario is within the realm of possibility in view of the past achievements.

▉ Scenario of shareholder value = double market capitalization

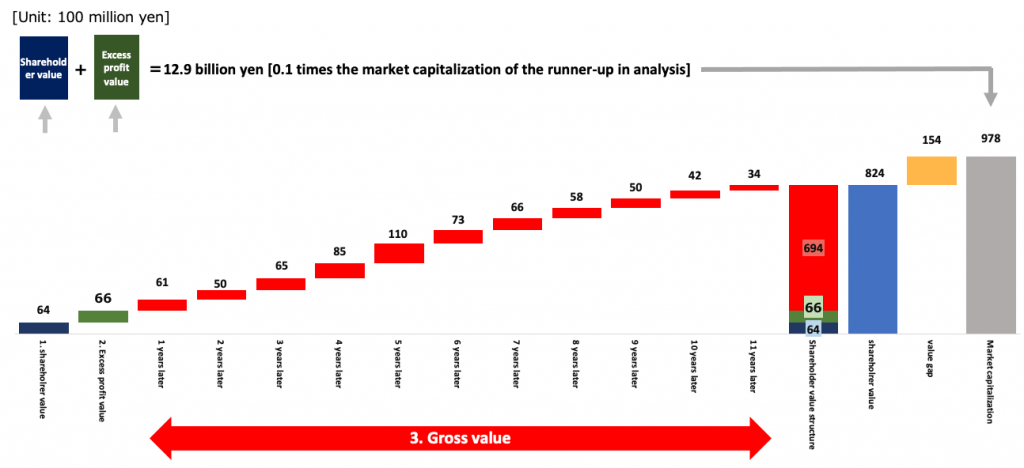

Stress test: Operating income decreased by 10% from the company plan, and then it decreased by 10% decreased (WACC 5%)

We conducted a stress test in which operating income decreased by 10% and sales decreased by 5% compared to the assumptions on the previous page. As a result, the shareholder value will be 82.4 billion yen, which is 15% lower than the current market capitalization.

▉ Stress test:Current shareholder value VS Market capitalization analysis

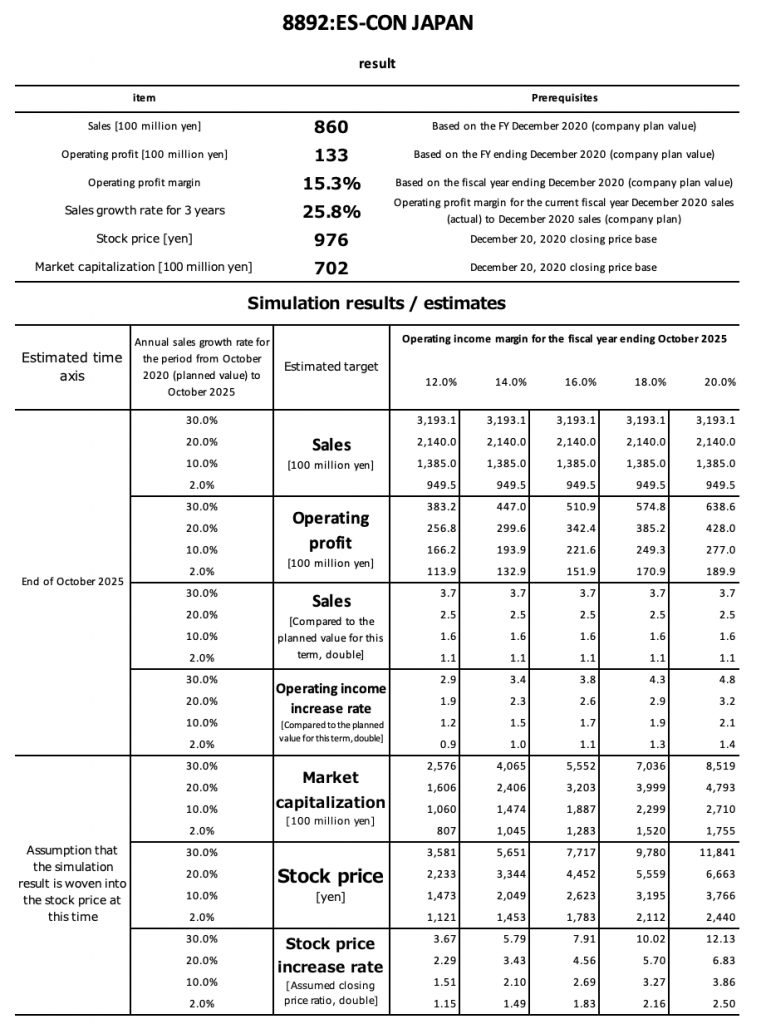

8892: Shareholder of ES-CON JAPAN Ltd.

Analyze the scenario of double market capitalization

Simulation based on Company-planned value: assumption of WACC 5%

ES-CON JAPAN Ltd. has a PBR more than 1, but its market capitalization is less than the total of shareholders' equity + excess profit value of 111.9 billion yen. Therefore, we estimatied that in the next five years or so, the sales growth rate will be around 7%, and the operating profit margin will gradually decline to the 14% level. Considering that sales growth is currently improving more than 20% and the operating income margin has been 14% for the fourth consecutive year, the scenario of shareholder value = double market capitalization is sufficiently realistic.

▉ Based on Company-planned value::Current shareholder value VS Market capitalization analysis

Stress test: Operating income decreased by 10% from the company plan, and then it decreased by 10% decreased (WACC 5%)

We conducted a stress test that operating profit decreased by 10% and sales decreased by 5% compared to the assumption of P8. As a result, the shareholder value was estimated to be 113.6 billion yen, and 1.6 times the market capitalization. It can be said that there is sufficient upside even if there is a stress test.

▉ Stress test:Current shareholder value VS Market capitalization analysis

Shareholder value index ranking

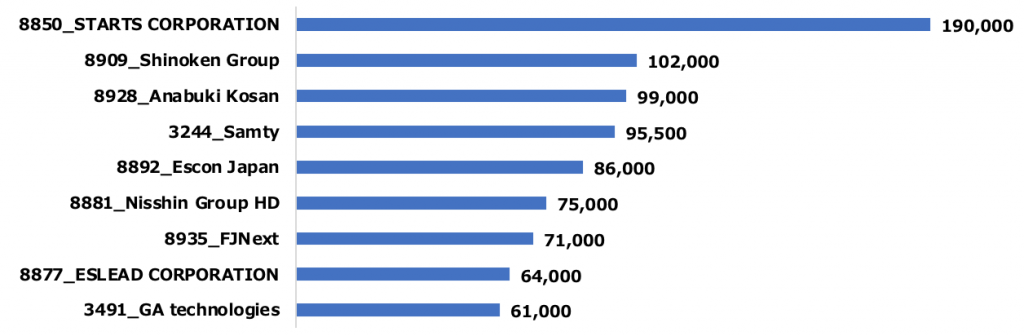

▉ Company plan / sales for this term(million yen)

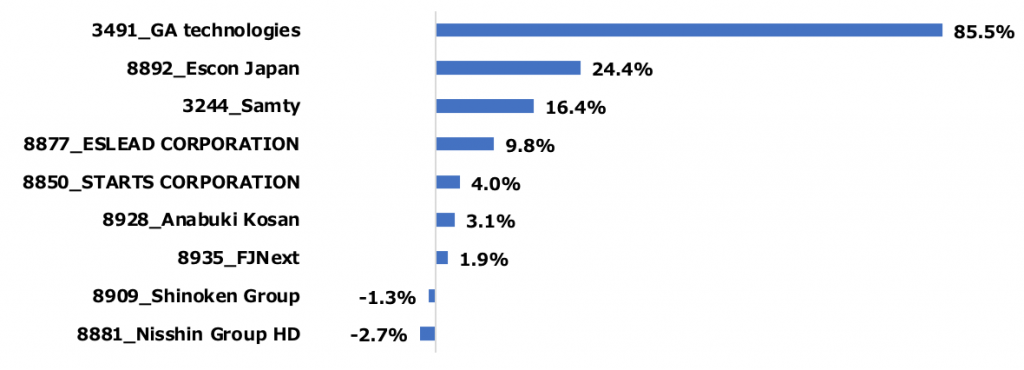

▉ Sales growth rate (2nd term before to this term, annualized)

▉ Sales growth rate (2nd term before to this term, annualized)

▉ Operating income margin (company plan for this term)

▉ Operating income margin (company plan for this term)

▉ After-tax operating income margin (company plan for the current term)

▉ After-tax operating income margin (company plan for the current term)

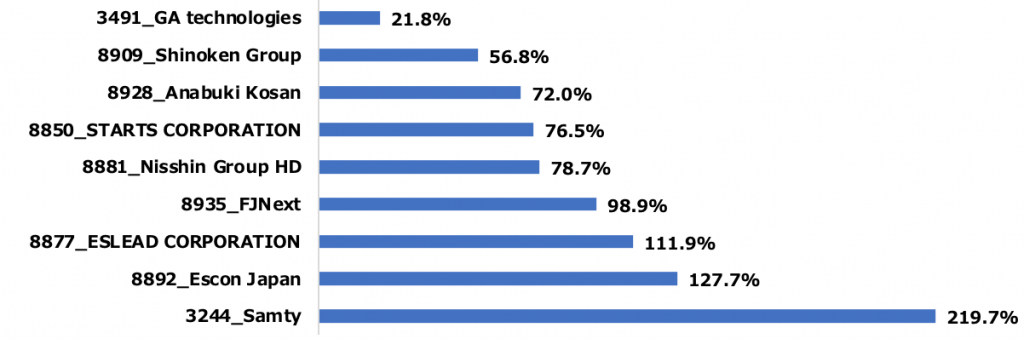

▉ Invested capital to sales ratio (Invested capital is at the end of the last quarter, sales are based on the planned value for this term)

▉ Invested capital to sales ratio (Invested capital is at the end of the last quarter, sales are based on the planned value for this term)

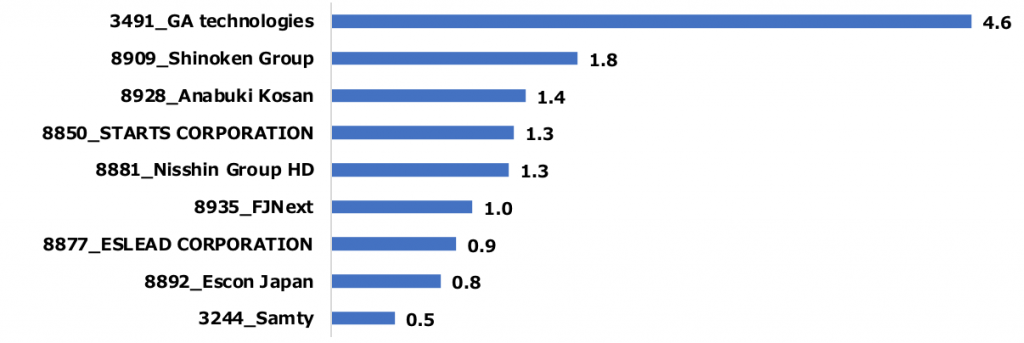

▉ Invested capital turnover period (Invested capital at the end of the most recent quarter, sales based on this term's plan)

▉ Invested capital turnover period (Invested capital at the end of the most recent quarter, sales based on this term's plan)

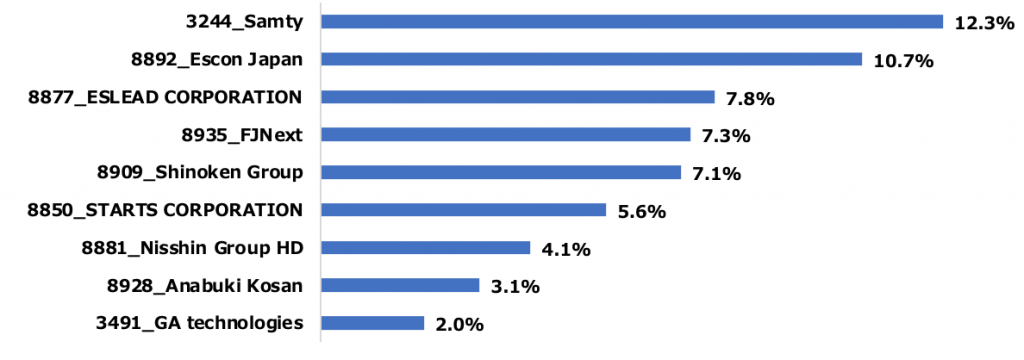

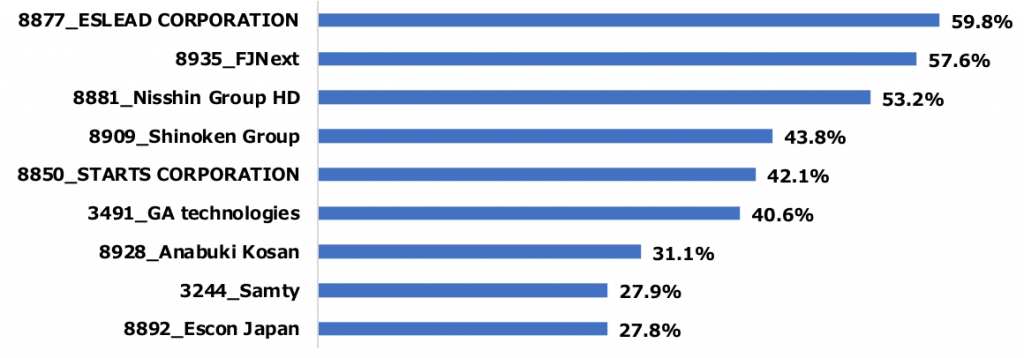

▉ ROE(Invested capital is analyzed based at the end of the most recent quarter, and operating income after tax is anlayzed based on this term's plan)

▉ ROE(Invested capital is analyzed based at the end of the most recent quarter, and operating income after tax is anlayzed based on this term's plan)

▉ Shareholders' equity ratio (end of last quarter)

▉ Shareholders' equity ratio (end of last quarter)

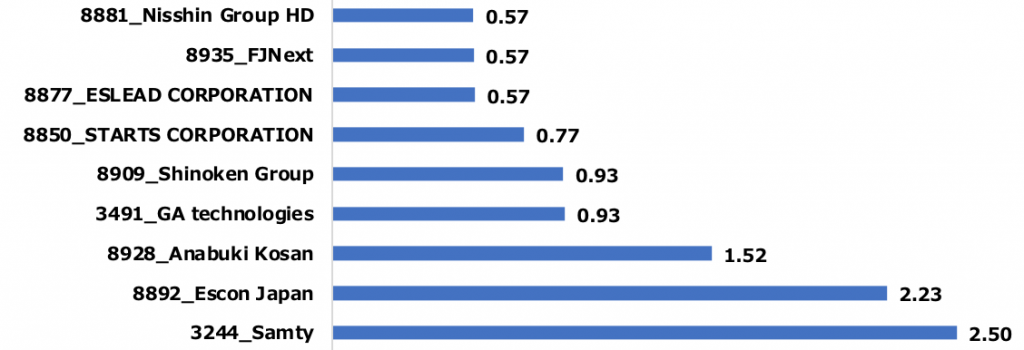

▉ Debt to Equity ratio (double, end of last quarter)

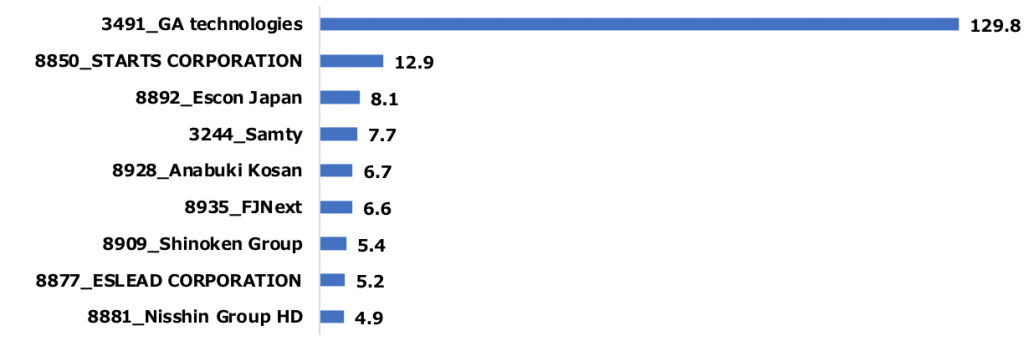

▉ PER (double, market capitalization closing price on October 20, 2020, net income based on company plan for this term)

▉ PER (double, market capitalization closing price on October 20, 2020, net income based on company plan for this term)

Please refer to the link below for the PDF version.

jpr_industryReport_condominium_development_ENG_20201110