IRの力で企業価値向上に貢献する ジェイ・フェニックス・リサーチ株式会社

Business Plan of AI-based friendly engagement fund in Japan

Business Plan of AI-based friendly engagement fund in Japan

J-Phoenix Research Inc. Osamu Miyashita, CFA, June 16th, 2019

Executive summary

Our vision

Our vision of the AI project enabling the strategic implementation of AI is the establishment of the world’s best “collective intelligent capability of human and AI” as a friendly activist fund.

Overall plan

Overall plan will be categorized threefold into 1) the cultural setting, 2) the establishment of our ability to drive our collective intelligence and 3) the establishment of the ability to drive the improvement of the value of the companies in which we invest by implementing collective intelligence into the companies’ culture, strategy building and daily operations.

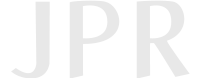

- The cultural setting: We believe a company should be a system to drive collective intelligence to create both the value improvement and the collective improvement of happiness of various stakeholders of a company at the same time. We should establish the cultural setting with which we can share the goal within our companies and companies in which we invest. We are trying to establish such a cultural setting on the basis of the concept of Maslow's hierarchy of needs and three fundamental value drivers: 1) sales growth, 2) return on invested capital [ROIC], and 3) cost of capital. The concept is described in detail in the following figure. We have a trademark, “GCC Management System”, described in the figure below

- The establishment of our ability to drive our collective intelligence: Firstly, we plan to establish the capability of NLP(Natural Language Processing) analysis to sort how each strategy statement relates to Maslow’s desire stage and the three value drivers of companies efficiently. Secondly, we plan to establish the ability of AI recommendation system to deliver the best strategy path to improve the collective intelligence of companies to achieve the maximization of the market value and happiness of stakeholders of companies.

- The establishment of the ability to drive the improvement of the value of the companies: We are planning to establish to the ability to identify the opportunities of the value creation of the companies through the understanding of what AI can do easily and or hard at the current stage and the ability to install the change leadership into the companies in which we invest to implement to collective intelligence into the opportunities we found.

Evaluation based on Porter’s three generic strategy.

We strongly believe the strategy described above leads to the differentiation. I spent a lot of time to find the similar strategy through web search and I have a lot of discussion with various friend of financial industry, but I did not find the similar idea described above. Most activist funds only focus on the value of the companies and most AI funds only focus on the technologies. Our focus on the both will lead to the differentiation from the view of Porter’s generic strategy.

Current state

- The cultural setting:

We believe that we have already created a differentiated cultural setting based on the concept of Maslow's hierarchy of needs and three fundamental value drivers as described above.

I spent a lot of time to find the similar cultural settings through a web search and I have a lot of discussion with a various friend of the financial industry, but I did not find the similar idea described above. Most cultural setting frameworks focus on either value or happiness. By focusing on the value of the companies and the happiness of all stakeholders around the companies in which we invest, we can have more smoothly to create “the goal to achieve the “collective intelligent with the interaction between human and AI”.

- The establishment of our ability to drive our collective intelligence:

We have already established the data-driven analysis culture and ability in the selection process. As a result, we have established to create an analyst report described below with just 2-3 seconds automatically for all 3,500 listed Japanese companies and we update the data every day automatically.

In addition to that, we hope that NLP analysis sort how each strategy statement relates to Maslow’s desire stage and the three value drivers of companies efficiently. Currently, we sort thousands of strategies by manually reading, and it takes a lot of time. If AI assists this work, then our productivities will improve significantly.

- The establishment of the ability to drive the improvement of the value of the companies:

With cultural setting described above, we have already established to the ability to institutionalize the new approaches to the companies in which we invest. We utilize the cultural setting described above so that we can have shared goal with shareholders and employee of companies, because we focus on both value of companies and the happiness of all stakeholders of companies. This approach should be implemented with the consideration of the process transformation pitfalls described in the paper of “Leading Change: Why transformation efforts fail, by John P. Kotter, HBR”

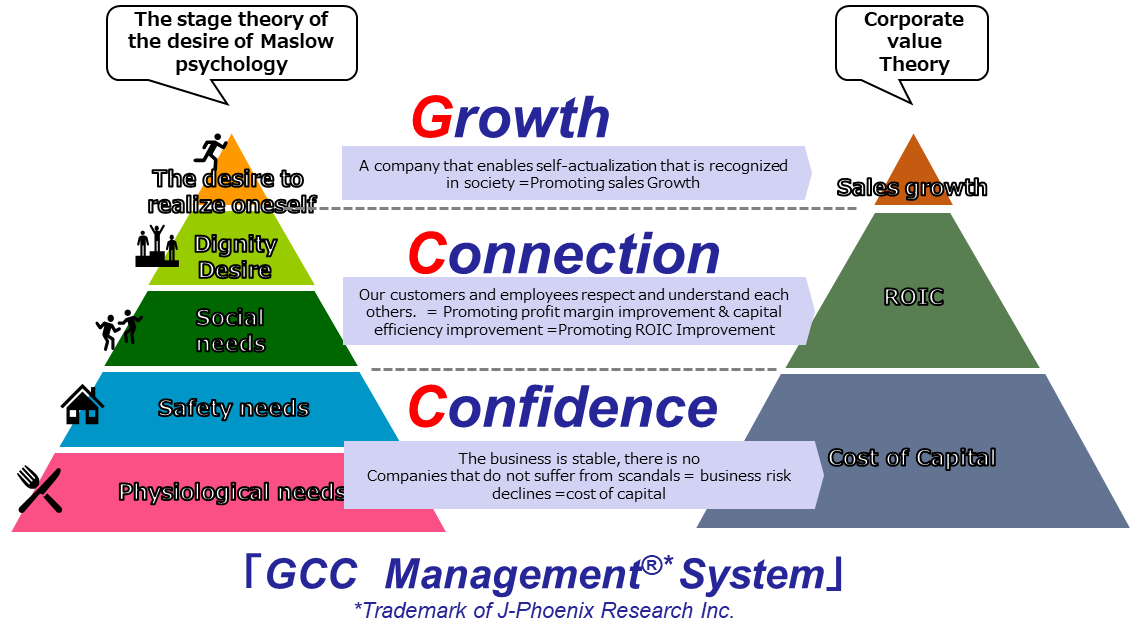

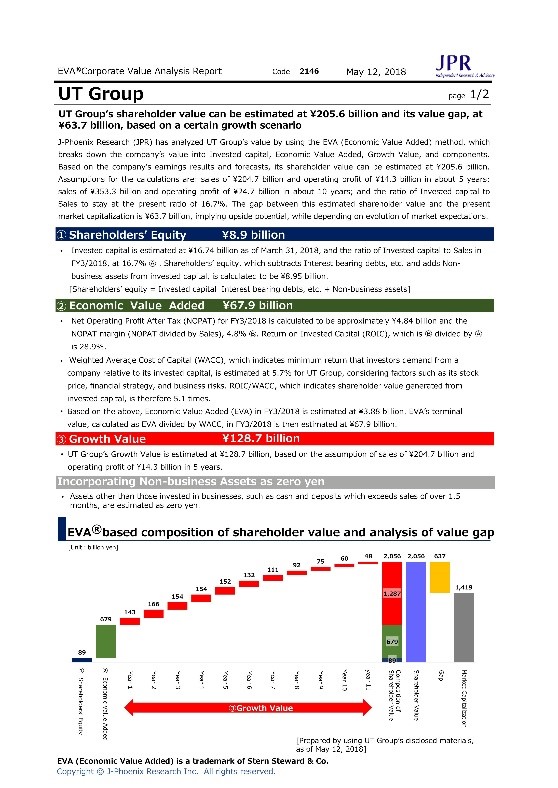

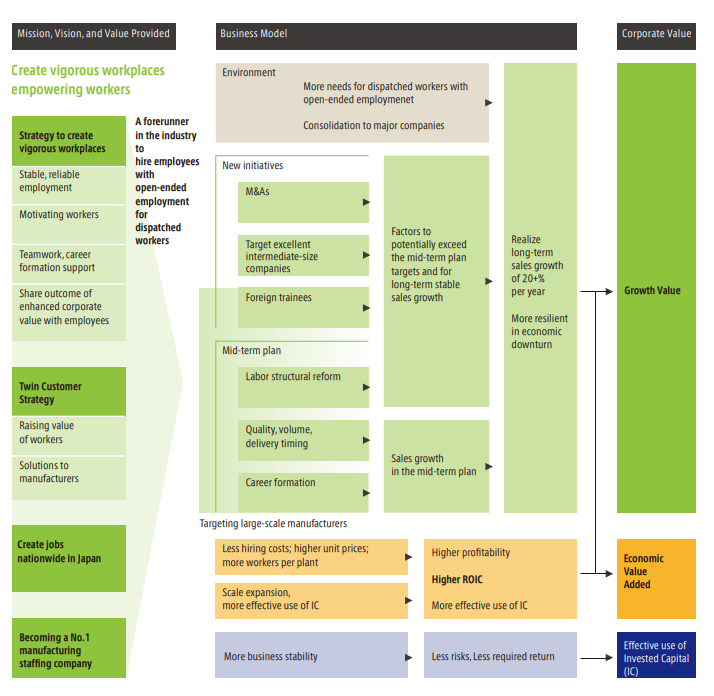

The figure below shows the outline of one of the best success engagement projects for UT Group (2146), which is a leader company of the dispatching staff members to various leading manufacturing companies in Japan. We have engaged in this company since October 2013 and the stock price increased 5 times since then our involvement.

https://ssl4.eir-parts.net/doc/2146/ir_material12/100452/00.pdf

We have established “differentiation” form Porter’s generic strategy through the implementation of those strategy described above.

Proposed initiative

The establishment of our ability to drive our collective intelligence:

We think ML(Machine learning) and NLP(Natural Language Processing) will be implemented in this area.

[ML]

We strongly believe the cost of the data analysis will be significantly reduced through ML regarding “Selection” process of investment.

In the selection process of investment activities, we model the value of companies and create a database to solve and run the model to generate a list of undervalued companies. Then we set an appointment to have a discussion with listed companies to identify the reason of the undervaluation.

Currently, we analyze only financial data with computers. In addition, we manually analyze text data disclosed by companies to identify “Buy”-companies which are about to change to improve value. By implementing ML for those process, the cost of the “Selection” process would reduce significantly. We believe ML of this process will lead to “cost leadership”

[NLP]

We strongly believe the cost of the data analysis will be significantly reduced through ML regarding “planning” process of investment.

In the planning process”, we hope that NLP analysis sort how each strategy statement relates to Maslow’s desire stage and the three value drivers of companies efficiently. Currently, we sort thousands of strategies by manually reading, and it takes a lot of time. If AI assists this work, then our productivities will improve significantly. We believe NLP of this process will lead to “cost leadership”

The establishment of the ability to drive the improvement of the value of the companies:

We think all of the ML, NLP, and robotics will be implemented in this area.

As a friendly activist fund (an engagement fund), our vision is to have an ability to advice how AI improve the value companies in the framework of our investment philosophy described in the previous statement of this assignment.

AI will change the rule of the game of the competitions of any industries we invest in. We believe strongly that we can create a strong competitive edge of differentiation from the porters’ view by having an ability to advise the companies invested regarding how to implement AI to have the maximization of the value of the companies.

To achieve that, we must understand the process of change in detail and estimate the potential impact of the value creations through the implementations of AI according to the unique situations of each industry. We are expert in the valuation of the companies, investment management, and also executions of the engagement process to let the companies implement the value creation strategy. If we have the ability described above regarding robotics, we believe we have very strong differentiation as a friendly activist fund.

[Technical requirements]

The technical requirements necessary to roll out the proposed initiative is the deep understand of what AI can do easily or hard and systematic way to create a database as a good feed for AI.

[Managerial leadership]

The managerial or leadership requirements necessary to roll out the proposed initiative are 1) the deep understanding of AI, 2) understanding the pitfalls of AI implementation process and 3) carefully consider ration monitoring process.

[Fits to the organization]

Because we have a data-driven analysis culture, we believe those initiatives fit our organization very well.

[Benefits]

We create the maximization of the value of the companies and happiness of the stakeholders of companies in which we invest. Therefore, we believe we can provide huge benefits both for our investors who invest in our funds and the stakeholders of companies in which we invest.

Plan of action and criteria for success

An overview of the project plan, with a brief indication of the timelines or milestones

- In 2019, we will establish the NLP and ML ability to improve our selection processes. In addition to that, we would like to understand deeply what AI can do easily and what AI can do hard.

- In 2020, we will establish an ability to project management as an engagement process to improve the value of the companies we invest by using AI. We must consider carefully to avoid pitfalls for the change leadership. We have already several engagement processes of the companies in which we invest. Among those companies we try to create the project management ability for changes implementing AI for collective intelligence within companies in which we invest.

The skills that we need to build, contract for, or acquire

- We must have a deep understanding of what AI can do easily and what AI can do hard.

- We must have a deep understanding of the database for feeding of AI.

- We must have a deep understanding of collective intelligence between AI and human.

- We must have skills to have a discussion with AI experts and translate the discussion to the managers without AI knowledge. We must have the ability to educate managers of the companies with the necessary knowledge to implementation of AI

- We must also project management skill specific to the AI implementations.

The key stakeholders involved in rolling out our proposed initiative& The organizational aspects involved in rolling out our proposed initiative

- The most important key stakeholders are the CEO and managers of the companies in which we invest. We must have the ability to create a shared vision for the goal regarding how companies will change by implementing Al.

Any ethical concerns or risks, and how we propose to mitigate them

- We should have the ethical consideration to select companies which use AI for an operational process. We should avoid the companies which have less awareness of the ethical issues of the use of AI, by having the code of ethics of AI for the process.

- We should focus on the ethical consideration for designing and implementations of robotics which lead to the value creations of the companies we invest. To do this we must have our own code of the ethics of robotics implementation.

Jobs in the organization

- We believe the most important job is the trainer who can educate people with the necessary knowledge of AI implementation. We also expect huge needs for jobs related to the database creations. We believe routine work and analytical work of the disclosed text will be eliminated significantly.

Criteria of the success

We think market value increase of the companies in which we invest and the result of a Questionnaire survey of the employee of those companies are the criteria of our success.